new mexico gross receipts tax return

However the New Mexico Taxation and Revenue Department can assess tax back from 6 - 10 years under conditions of under-reporting by at least 25 non-filed reports andor tax fraud. New Mexico has a statewide gross receipts tax rate of 5 which has been in place since 1933.

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

The correct rate is 81875 and the location code is 13-114.

. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business. The current gross receipts tax rate in New Mexico is 5125. Depending on the volume of sales taxes you collect and the status of your sales tax account with New Mexico you may be required to file sales tax returns on a monthly semi-monthly.

A 2-per-day leased vehicle surcharge is also imposed on certain vehicle leases. Filing online is fast efficient easy and user friendly. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services.

Gross Receipts by Geographic Area and NAICS Code. May be claimed only by national laboratories operating in New Mexico and is applied against gross receipts taxes due up to 1800000 excluding local option gross receipts taxes. Incorrect Gross Receipts Tax GRT rate for the city of Gallup for the current July-January period.

The same goes for. Collection and distribution data of the gross receipts tax are also provided in the Monthly Local. Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT.

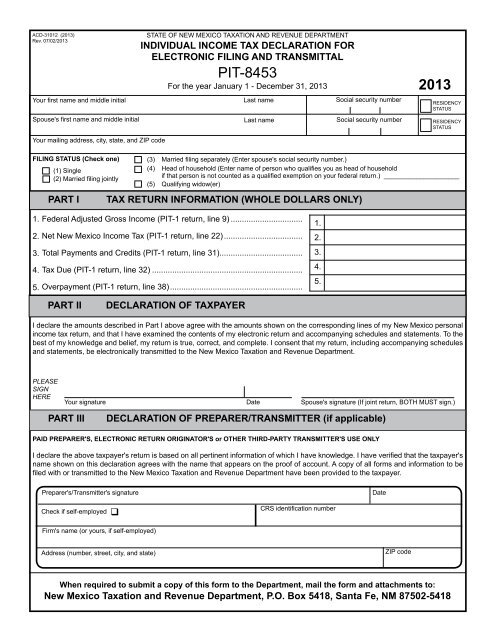

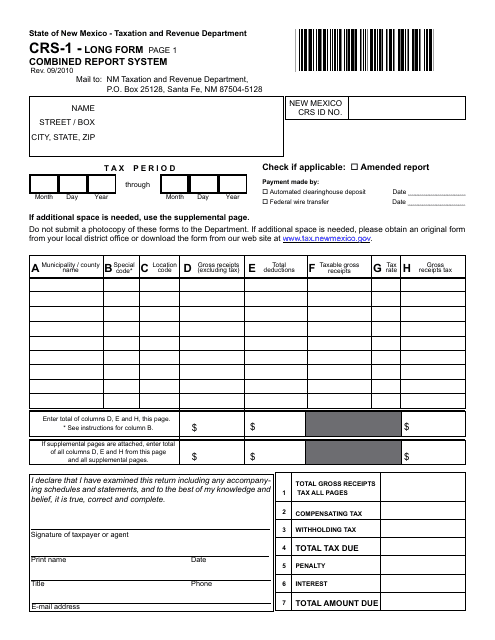

Gross Receipts by Geographic Area and 6-digit NAICS Code. A gross receipts tax permit can be obtained by registering for a CRS Identification Number online or submitting the paper form ACD-31015. Filing your Gross Receipts Tax GRT online takes the stress out of work so you have time for more enjoyable things.

The current maximum rate for local and county taxes is. We urge you to give. Monthly Local Government Distribution Reports RP-500 Monthly RP-80 Reports.

When billing a customer for Gross Receipts Tax on or after July 1 2019 New Mexico mandates that taxpayers need to separately state the amount of tax associated with. For the privilege of engaging in business an excise tax equal to five and one-eighth percent of gross receipts is. Denomination as gross receipts tax.

After registering the business will be. On April 4 2019 New Mexico Gov. Double-click a form to download it.

Report the regular gross receipts tax the leased vehicle gross receipts tax and the leased vehicle. New Mexico Taxpayer Access Point allows taxpayers to file their taxes make payments check refund statuses manage their tax accounts register new businesses and more. The tax is imposed on the gross receipts of businesses or people who sell property perform services lease or license property or license a franchise in New Mexico.

Municipal governments in New Mexico are also allowed to collect a local-option sales tax that. The Gross Receipts Tax rate varies throughout the state from 5125 to 94375. It varies because the total rate combines rates.

New Mexico first adopted a version called a gross receipts tax in 1933 and since that. Note that there may be local taxes that apply to your business as well. Imposition and rate of tax.

Tax Filing Season 2022 What To Do Before January 24 Marca

Made A Tax Return Mistake Fix It By X Filing An Amended Return Don T Mess With Taxes

Understanding The 1065 Form Scalefactor

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Taking A Peek At Obama Biden 2014 Tax Returns Don T Mess With Taxes

Pin On Global Multi Services Inc

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

Form Taxation And Revenue Department State Of New Mexico

Arizona Tax Forms 2021 Printable State Az Form 140 And Az Form 140 Instructions

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller

Here S Some Good Tax News Study Finds Tax Changes Haven T Impacted Home Values Http Qoo Ly Xq732 Income Tax Onondaga County Income

Tax Stimulus Checks See The 14 States That Are Sending Out Tax Rebate Payments Marca

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 12 16 Corporate Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service